The State Bank of Pakistan (SBP) is gearing up for a significant milestone in the country’s monetary history. Governor Jameel Ahmad has announced plans to introduce a new series of currency notes, starting mid-2025. This move comes with the promise of enhanced security features and modernized designs, as the central bank aims to keep pace with international standards.

This blog dives into the details surrounding the rollout process, design updates, technological advancements, and more. Here’s everything you need to know about Pakistan’s upcoming currency transformation.

Why New Currency Notes are Being Introduced

The introduction of new notes aligns with global practices, where central banks update banknote designs every 15–20 years. This approach is essential to:

- Reinforce Security: Incorporating the latest security features helps combat counterfeiting.

- Modernize Design: Align currency aesthetics with modern trends and advanced technology.

- Enhance Usability: Improve durability and user-friendliness of notes in daily transactions.

Pakistan’s existing currency series has been in circulation for years, and this overhaul presents an opportunity to address these key areas.

Key Details of the Rollout Plan

Gradual Introduction of Notes in 2025

Governor Jameel Ahmad emphasized a phased rollout for the new currency notes rather than an overnight switch. Each denomination will be introduced one at a time, ensuring smooth integration into the country’s monetary system.

The approval process from the federal cabinet is expected to be finalized in the next few months, ideally before June 2025. The first denomination’s rollout is anticipated post-July 2025, marking the start of the fiscal year 2025-2026.

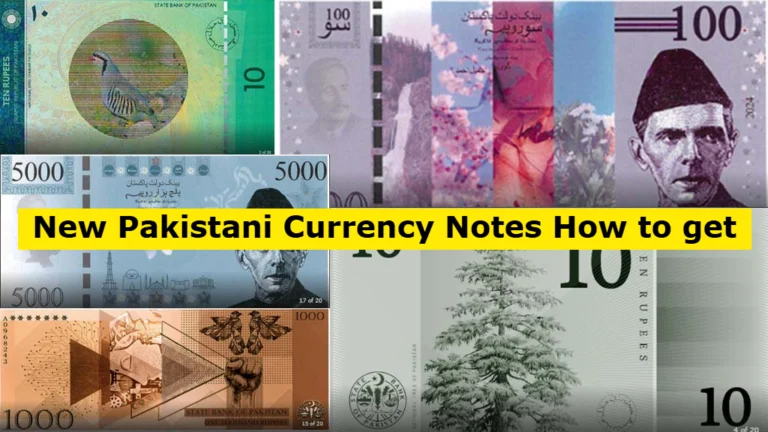

But which denomination will kick off the series? That decision is yet to be made public. Currently, Pakistan’s currency lineup includes Rs10, Rs20, Rs50, Rs100, Rs500, Rs1,000, and Rs5,000 notes.

Security Papers Limited’s Plant Upgrade

On the production front, Security Papers Limited (SPL)—responsible for producing the security paper used in banknotes—has disclosed plans for a crucial upgrade to its manufacturing plant. This upgrade, slated to take 18 months, will enable SPL to meet international security standards. Without this enhancement, producing new, secure currency would not have been feasible.

The Art Behind the New Currency

Designing a country’s currency is no small feat. Back in early 2024, the SBP organized an art competition to crowdsource designs for the upcoming notes. The competition saw a fantastic response from artists and citizens nationwide, with the winning designs being selected after rigorous evaluation by a panel of esteemed experts.

Winning Designers

Several talented individuals stood out during the competition, including winners such as Dr. Shery Abidi, Haroon Khan, and Hadiya Hassan. Their designs have now been forwarded to international designers for collaboration with the SBP, ensuring the final currency series is a blend of local creativity and global standards.

The new designs are expected to represent Pakistan’s cultural heritage while symbolizing progress and international relevance.

Upcoming Digital and Financial Innovations from SBP

The new currency rollout isn’t the only initiative Pakistan’s central bank is working on. Governor Ahmad also unveiled plans for two significant financial technological advancements:

Launch of the InvestPak Platform

The SBP is set to launch a digital investment platform called “InvestPak”. This platform will allow both individuals and corporate investors to directly invest in government debt securities such as Treasury Bills (T-bills) and Pakistan Investment Bonds (PIBs). Currently under testing, InvestPak is expected to simplify investment processes and increase accessibility for all types of investors.

Progress Toward a Central Bank Digital Currency (CBDC)

Pakistan also aims to move into the digital currency space with the introduction of a Central Bank Digital Currency (CBDC). The SBP is working closely with the government to establish a legal framework, paving the way for this innovative project.

What Does This Mean for You?

The upcoming changes signify more than just updated currency notes. Here’s what these developments mean for citizens, businesses, and the broader economy:

- Enhanced Security: With stricter anti-counterfeiting measures, the risk of fake currency entering circulation will reduce.

- Improved Efficiency: New designs are likely to include features that improve handling, durability, and usability.

- Global Competitiveness: The changes bring Pakistan’s currency up to international standards, boosting confidence in its banking system and financial infrastructure.

- Community Engagement: Initiatives like the design competition and publicized rollout plans reflect transparency and encourage citizen involvement.

Looking Forward

The introduction of new currency notes marks an exciting chapter for Pakistan’s financial landscape. It blends technological advancement, artistic creativity, and global standards into a single venture that benefits every stakeholder be it citizens, businesses, or policymakers.