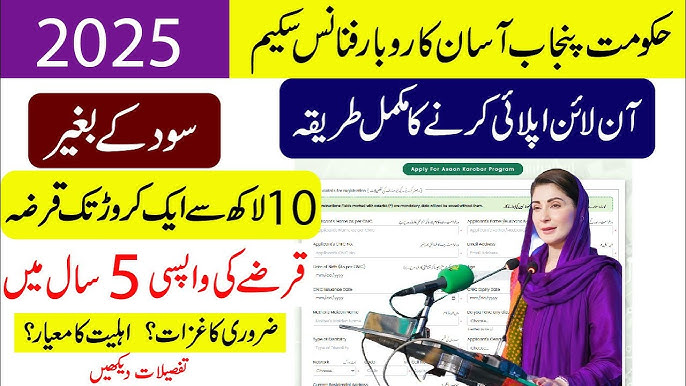

Are you an entrepreneur looking to scale your small business in Punjab? The Maryam Nawaz Loan Scheme is here to empower small entrepreneurs with easy access to interest-free loans of up to PKR 1 million. This initiative aims to provide a financial boost to ensure sustainable growth for small businesses while promoting a transparent and digital approach for fund utilization.

If you’re wondering how you can benefit from this opportunity, we’ve outlined everything you need to know from key features of the loan scheme to the step-by-step application process.

What Is the Maryam Nawaz Loan Scheme?

The Maryam Nawaz Loan Scheme offers interest-free loans to Small Entrepreneurs (SEs) in Punjab through a digital SME card. The amount can be used for business-related transactions and supports entrepreneurs in running or expanding their businesses.

This scheme stands out due to its transparent and structured financial distribution, relying on digital platforms like mobile apps and point-of-sale (POS) systems for loan utilization.

Here are the standout features that make this scheme a game-changer for entrepreneurs in Punjab.

Key Features

- Maximum Loan Limit: PKR 1 million

- Tenure of Loan: 3 years

- Loan Type: Revolving credit facility valid for 12 months

- Repayment Term: Pay over 24 equal monthly installments, starting after the first year!

- Interest Rate: 0% interest

- Grace Period: 3 months

Funds Usage

The loan is flexible and can be used for business-centric needs, such as:

- Payments to vendors and suppliers

- Easily pay your utility bills, government fees, and taxes hassle-free

- Cash withdrawal for miscellaneous business expenditures (up to 25% of the limit)

- Performing digital transactions through POS or mobile apps

These features provide entrepreneurs with a comprehensive financial tool to handle day-to-day business operations effectively.

Eligibility Criteria

To gain access to this unparalleled opportunity, you must meet the following requirements:

- Residency

- Open to passionate Pakistani nationals currently living in Punjab!

- Business must be existing or prospective and located in Punjab

- Personal Details

- Age between 21 and 57 years

- Valid CNIC and a mobile number registered in the applicant’s name

- Credit Screening

- Clean credit history (no overdue loans)

- Satisfactory credit and psychometric assessment

- Application Limit

- Only one application per individual or business

By fulfilling these criteria, you demonstrate your commitment and suitability for the scheme.

How to Apply

The application process for the Maryam Nawaz Loan Scheme is simple and convenient, thanks to its digital infrastructure. Here’s how you can apply step by step:

Step 1: Register Online

- Visit the PITB portal to submit your application digitally.

- Pay a non-refundable PKR 500 processing fee during the application process.

Step 2: Verification

- The government digitally verifies your CNIC, creditworthiness, and business premises. This ensures transparency and accountability.

Step 3: Loan Approval and Card Issuance

- If approved, you will receive a digital SME card for loan utilization.

Once approved, you’re ready to use your digital SME card for business purposes.

Loan Usage and Repayment Details

Managing your loan effectively is essential for maintaining good standing. Here’s how the loan usage and repayment process works:

- Usage of the First 50% Limit

- The borrower can use 50% of the approved loan limit within the initial six months.

- Grace Period

- Borrowers enjoy a three-month grace period before repayment starts.

- Initial Repayment

- After three months, borrowers start with monthly repayments, with a minimum monthly payment of 5% of the outstanding balance (principal only).

- Second 50% Limit

- The remaining 50% is released based on satisfactory usage, timely repayments, and registration with PRA/FBR.

- Final Loan Repayment

- After the first year, the loan’s remaining balance is repaid in 24 equal monthly installments (EMIs) over two years.

These structured processes ensure that entrepreneurs have sufficient room to manage their finances while growing their businesses.

Additional Charges and Fees

Although the loan is interest-free, certain charges and fees are included to ensure a smooth process:

- Annual Card Fee: PKR 25,000 + FED (automatically adjusted from your approved limit)

- Other Charges: Life assurance, card issuance, and delivery charges, covered by the scheme

- Late Payments: Late payment charges as per the bank’s policy

These minor expenses are a small price to pay for the invaluable benefits the scheme provides.

Security Details

The scheme includes several layers of security to ensure loan integrity and borrower accountability.

- Guarantee

- A digitally signed personal guarantee is provided by the borrower.

- Physical Verification

- The Urban Unit conducts inspections of business premises within six months of loan approval and annually thereafter.

- Life Assurance

- Borrowers are automatically enrolled in a life assurance plan as part of the portfolio security.

These checks and balances protect both the borrower and the institution offering the loan.

Key Conditions

Some important terms to keep in mind include:

- Funds are restricted to core business activities, and any non-business-related transactions (e.g., personal consumption) are blocked.

- Don’t forget registration with PRA/FBR is a must within six months!

- The scheme allows only one application per individual/business.

Make sure you comply with these conditions to fully leverage the benefits of the program.

Need Assistance?

If you’re unsure about the feasibility of your business idea, resources are available to guide you. Visit the PSIC and BOP websites for entrepreneurial feasibility studies tailored for startups.

For any queries, you can contact the helpline by dialing 1786

The Maryam Nawaz Loan Scheme is a golden opportunity for entrepreneurs looking to establish or expand their small business. With zero interest, flexible repayment options, and a structured digital process, it’s tailored to help Punjab’s entrepreneurs thrive.